International trade

4.1 Exports

Canadian exports of marine, freshwater and aquaculture fish and seafood products reached a total value of $4.09 billion in 2006, which is $219 million less than in 2005. This is mainly attributable to decreases in the price of snow crab, shrimp and herring. The most valuable Canadian exports in 2006 were lobster, farmed salmon, shrimp and snow crab, which combined represented almost 60% of the total value of Canadian seafood exports during the year.

| Species | Export Value ($m) | |||

|---|---|---|---|---|

| 2004 | 2005 | 2006 | % change

2005-2006 |

|

| Groundfish | 481 | 476 | 442 | -7% |

| Cod, Haddock | 154 | 126 | 111 | -12% |

| Halibut, Flounders | 115 | 98 | 76 | -22% |

| Hake | 59 | 69 | 85 | 24% |

| Greenland Turbot | 39 | 61 | 55 | -10% |

| Other | 114 | 122 | 115 | -6% |

| Pelagic fish | 912 | 1,014 | 992 | -2% |

| Herring, Mackerel, Sardines | 241 | 280 | 209 | -25% |

| Salmon, farmed | 404 | 492 | 540 | 10% |

| Salmon, wild | 170 | 150 | 145 | -3% |

| Tuna | 39 | 31 | 29 | -7% |

| Other | 59 | 62 | 69 | 12% |

| Shellfish | 2,653 | 2,423 | 2,278 | -6% |

| Lobster | 952 | 992 | 1,004 | 1% |

| Crab, snow | 659 | 488 | 426 | -13% |

| Crab, other | 266 | 159 | 94 | -41% |

| Shrimp | 438 | 478 | 456 | -4% |

| Scallop | 131 | 108 | 100 | -8% |

| Clams | 109 | 99 | 101 | 2% |

| Other | 97 | 99 | 97 | -2% |

| Other marine species | 277 | 275 | 263 | -5% |

| Freshwater fish | 132 | 124 | 118 | -5% |

| Perch | 26 | 25 | 23 | -8% |

| Pickerel | 37 | 37 | 39 | 6% |

| Other | 68 | 62 | 56 | -10% |

| Total | 4,455 | 4,313 | 4,094 | -5% |

Source: Statistics Canada, International Trade Division.

In 2006, most species experienced only minor fluctuations in terms of export values. However, farmed salmon exports increased by $48 million (+10%) from 2005 due to a higher price in 2006. Hake exports also experienced a good year with an increase of $16 million (+24%).

On the other hand, the value from sardine exports decreased by $71 million (-25%). Rock crab and Pacific Dungeness crab exports decreased by $65 million (-41%). Snow crab have followed a similar trend with a $62 million (-13%) decrease compared to 2005. Halibut and other flounders also showed a decrease of $22 million (-22%). Finally, cod and haddock also had weaker export performance, decreasing by $15 million (-12%).

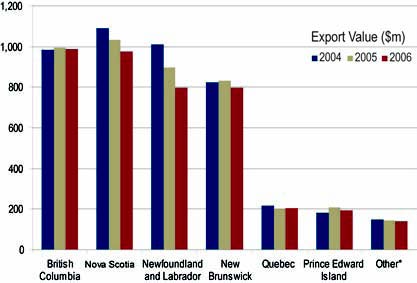

In 2006, the provinces of British Columbia, Nova Scotia, Newfoundland and Labrador and New Brunswick were the main exporters of Canadian seafood. Individually, the seafood export value of each of the provinces exceeded $750 million, and together they amounted to 87% of the total value of Canadian seafood exports in 2006.

Figure 4.1: Total value of Canadian seafood exports by province, 2004-2006

*Ontario, Manitoba, Saskatchewan, Alberta, Northwest Territories, Yukon, Nunavut.

Source: Statistics Canada, International Trade Division.

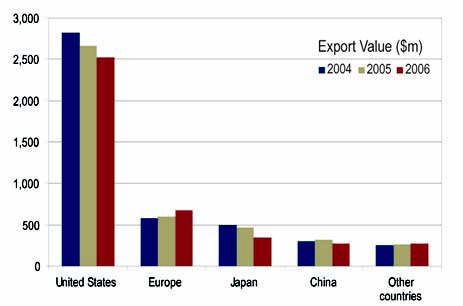

The main markets for Canadian fish and seafood are the United States, Japan and European countries. The United States remains the largest among these markets. Between 2004 and 2006, the US market has absorbed on average two-thirds of Canadian seafood product exports (in terms of value). The European market (mainly the United Kingdom and Denmark) came second with 14% of the export value, followed by Japan with 8%. Finally, 7% of Canadian exports of fish and seafood went to China in 2006.

Several countries showed growth in terms of an important export market for Canadian seafood products. Russia, ranked 11th in 2006, had a 107% increase in Canadian imports since 2004, from $21 million to almost $44 million. The Netherlands, ranked 13th, imported over $31 million of Canadian seafood exports, up from $17 million in 2004 (+84%). The Ukraine showed a sharp increase of 477% since 2004, from $4 million (ranked 29th) to nearly $25 million, now ranked 15th.

Figure 4.2: Value of Canadian seafood exports by major markets, 2004-2006

Source: Statistics Canada, International Trade Division.

Sockeye, Pink and Chum salmon exports from British Columbia and northern shrimp, spiny dogfish and mackerel exports from the Atlantic Provinces mainly went to the European market in 2006. As for the American market, it absorbed most Canadian exports of lobster, aquaculture salmon, Chinook, Coho and sockeye salmon, scallop, snow crab and most groundfish, except for hake. Finally, Japan was the main destination for herring, sea urchin, albacore tuna, Pacific Dungeness crab, Greenland turbot and sablefish.

Between 2004 and 2006, the share of the total export value of Canadian fish and seafood destined for the United States decreased from 63.4% to 61.7%, while that of Canadian exports to Europe rose from 13% in 2004 to 16.5% in 2006.

Figure 4.3: Share (%) of the value of Canadian exports, by major markets, 2004-2006.

Source: Statistics Canada, International Trade Division.

One likely cause of the decrease in Canadian seafood exports to the United States is the exchange rate. Between 2004 and 2006 the US dollar greatly depreciated in value against the Canadian dollar. In January 2004, for every Canadian dollar of imports, US importers were paying $0.77 US. This is in stark contrast to May, 2006 when U.S. importers were paying $0.90 US for each Canadian dollar of exports. In comparison, the value of the Euro has remained more stable against the Canadian dollar. This development made the European market more attractive to Canadian exporters, and partly explains the increase in exports to this market between 2004 and 2006.

Figure 4.4: Movement of exchange rates between the Canadian dollar and the US dollar, the euro and the japanese yen, 2003/01 – 2007/01

Source: Bank of Canada.

4.2 Imports

Canadian imports of marine, freshwater and aquaculture products reached a total value of $2.12 billion in 2006, which represents an increase of $42 million (+2%) compared to 2005. The main imported species were shrimp, lobster, tuna, salmon, cod and haddock. Together, these species represented almost half the total value of Canadian fish imports in 2006.

| Species | Import Value ($m) | |||

|---|---|---|---|---|

| 2004 | 2005 | 2006 | % change

2005-2006 |

|

| Groundfish | 322 | 284 | 281 | -1% |

| Cod, Haddock | 139 | 109 | 96 | -12% |

| Halibut | 83 | 84 | 96 | 14% |

| Other | 100 | 92 | 89 | -3% |

| Pelagic fish | 405 | 387 | 358 | -8% |

| Herring, Mackerel | 32 | 31 | 29 | -6% |

| Salmon, farmed | 37 | 30 | 23 | -23% |

| Salmon, wild | 180 | 169 | 149 | -12% |

| Tuna | 140 | 139 | 141 | 1% |

| Other | 16 | 18 | 16 | -11% |

| Shellfish | 887 | 909 | 918 | 1% |

| Lobster | 206 | 215 | 208 | -3% |

| Crab, snow | 10 | 2 | 5 | 165% |

| Crab, other | 51 | 72 | 79 | 11% |

| Shrimp | 409 | 391 | 409 | 4% |

| Scallop | 42 | 60 | 62 | 3% |

| Clams | 44 | 38 | 36 | -6% |

| Other | 126 | 130 | 119 | -9% |

| Other marine species | 370 | 409 | 464 | 13% |

| Freshwater fish | 72 | 85 | 95 | 12% |

| Total | 2,056 | 2,074 | 2,116 | 2% |

Source: Statistics Canada, International Trade Division.

The import value of shrimp, crab, halibut, yellowfin tuna and haddock has increased by $46.8 million in 2006, while that of sockeye salmon, cod, lobster and sole has decreased by $54 million. The provinces of Ontario, British Columbia, Quebec and New Brunswick were the main importers of seafood in Canada in 2006. Together, they accounted for 90% of the total value of Canadian seafood imports in 2006.

Figure 4.5: Total value of Canadian seafood imports by province, 2004-2006

*Prince Edward Island, Manitoba, Saskatchewan, Alberta, Yukon.

Source: Statistics Canada, International Trade Division.

In 2006, 37.7% of the total value of Canadian imports of fish and seafood came from the United States, for a total of $797 million. China came second with 16.6% of the total import value, followed by Thailand with 12.7%, and then Chile and Vietnam with 4.6% and 4.3% respectively.

Figure 4.6: Total value of Canadian seafood imports by major markets, 2004-2006

Source: Statistics Canada, International Trade Division.

- Date modified: